TS GREWAL SOLUTION 2021-22 ,VOLUME 3 , CHAPTER 5 – CASHFLOW STATEMENT SOLUTION

Note – we upload working note before the main solution because we want students would get full understanding about the question before moving forward in the solution.

Q.1- Identify the transactions as belonging to (i) Operating Activities, (ii) Investing Activities, (iii) Financing Activities and (iv) Cash and Cash Equivalents:

| (a) Cash Sale of Goods | (b) Cash Received against Revenue from Services rendered |

| (c) Cash Purchase of Goods | (d) Cash Paid against Services Taken |

| (e) Patents Purchased | (f) Marketable Securities |

| (g) Bank Overdraft | (h) Proceeds from Issue of Debentures |

| (i) Purchase of Shares | (j) Repayment of Long-term Loan |

| (k) Commission Received | (l) Redemption of Debentures |

| (m) Interest on Debentures | (n) Interest on Investments |

| (o) Income Tax Paid | (p) Income Tax Paid on Gain on Sale of Asset |

| (q) Cash Received from Debtors | (r) Cash Paid to Creditors. |

SOLUTION:-

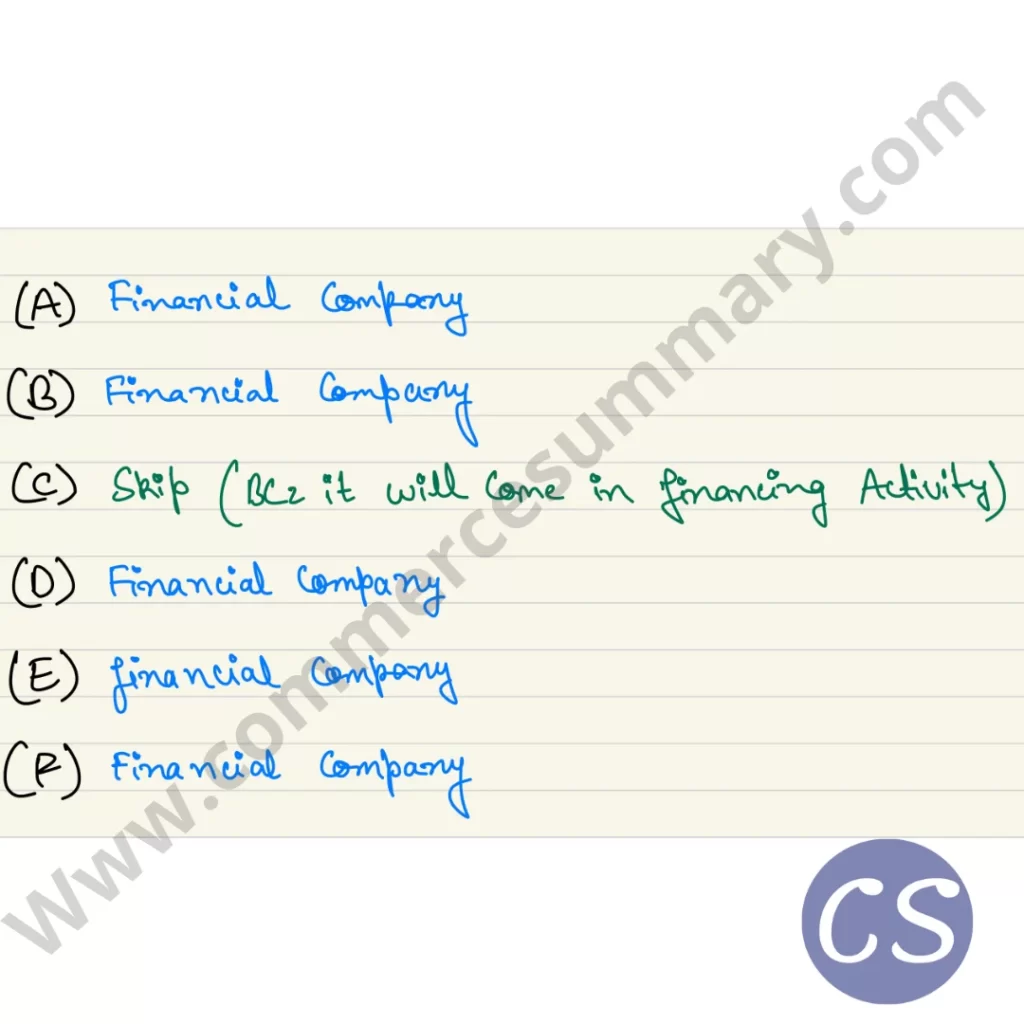

Q.2- Classify the following transactions as Operating Activities for a financial company and a non-financial company:

| (a) Purchase of Shares on a Stock Exchange. | (b) Dividend received on Shares. |

| (c) Dividend paid on Shares. | (d) Loans given. |

| (e) Loans taken. | (f) Interest paid on borrowings. |

SOLUTION:-

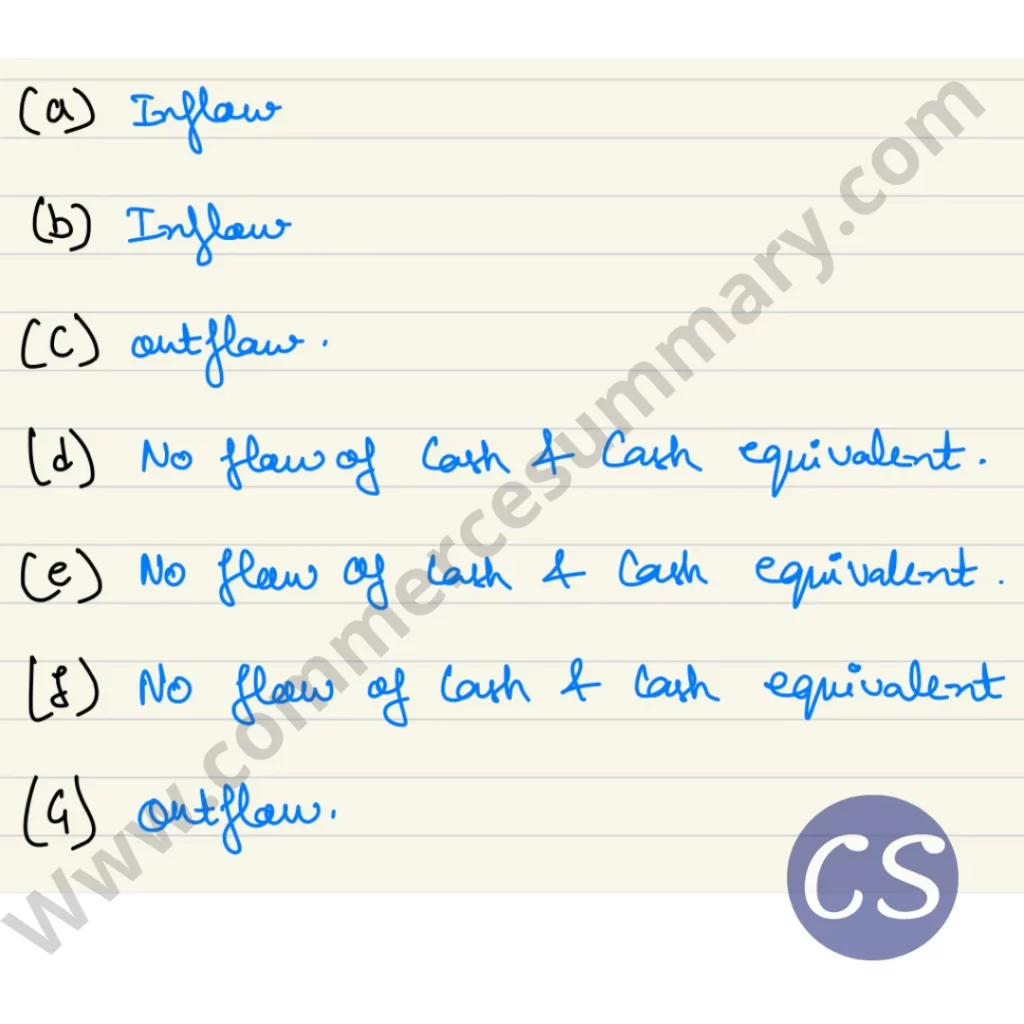

Q.3- State which of the following would result in inflow/outflow or no flow of Cash and Cash Equivalents:

(a) Sale of Fixed Assets, Book Value ₹ 1,00,000 at a profit of ₹10,000.

(b) Sale of goods against cash.

(c) Purchase of machinery for cash.

(d) Purchase of Land and Building for ₹10,00,000. Consideration paid by issue of debentures.

(e) Issued fully paid Bonus Shares.

(f) Cash withdrawn from bank.

(g) Payment of Interim Dividend.

SOLUTION:-

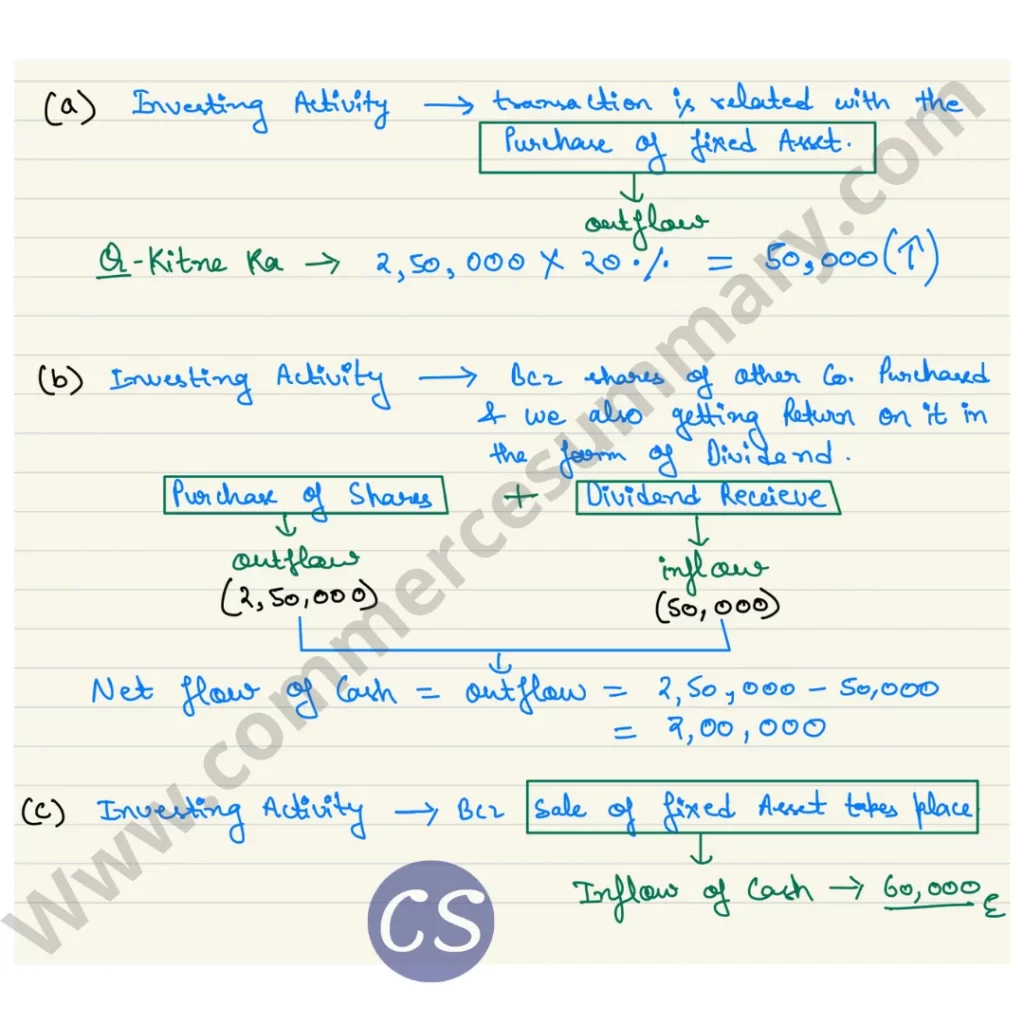

Q.4- For each of the following transactions, calculate the resulting Cash Flow and state the nature of Cash Flow, i.e., whether it is Operating, Investing or Financing activity:

(a) Acquired machinery for ₹ 2,50,000 paying 20% by cheque and executing a bond for the balance payable.

(b) Paid ₹ 2,50,000 to acquire shares in Informa Tech Ltd. and received a dividend of ₹50,000 after acquisition.

(c) Sold machinery of original cost of ₹ 2,00,000 with an accumulated depreciation of ₹1,60,000 for ₹ 60,000.

SOLUTION:-

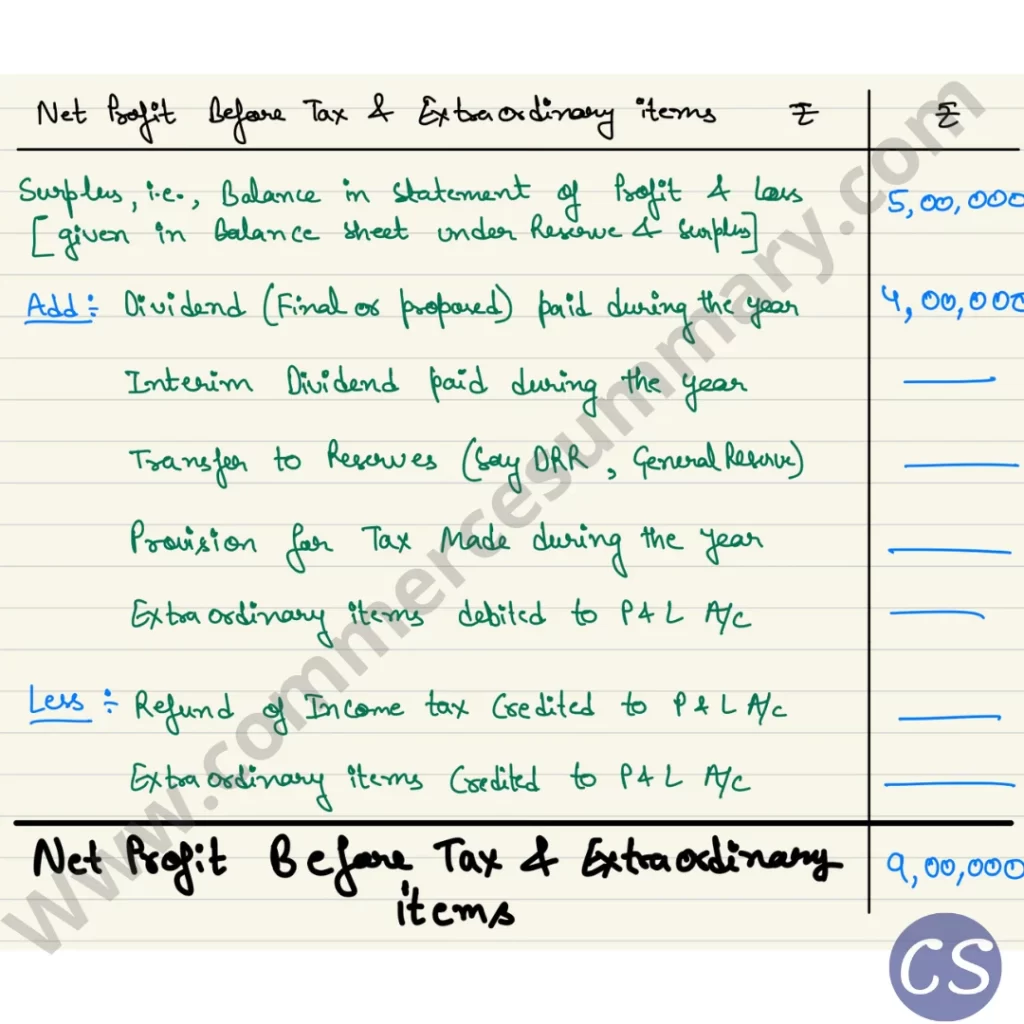

Q.5- Following are the extracts from the Balance Sheet of Karishma Ltd. as at 31st March, 2021:

| Particular | 31st March, 2021 ( ₹) | 31st March, 2020 ( ₹) |

| Surplus, i.e., Balance in Statement of Profit and Loss | 10,00,000 | 5,00,000 |

| Dividend Payable | 50,000 | – |

Additional Information: Proposed Dividend for the years ended 31st March, 2020 and 2021 are ₹ 4,00,000 and ₹ 5,00,000 respectively.

Prepare the Note to show Net Profit before Tax and Extraordinary Items.

SOLUTION:-

Q.6- Following is the extract from the Balance Sheet of Zee Ltd.:

| Equities & Liabilities | 31st March, 2021 ( ₹) | 31st March, 2020 ( ₹) |

| Equity Share Capital | 8,00,000 | 8,00,000 |

| 10% Preference Share Capital | 6,00,000 | 6,00,000 |

| Surplus i.e., Balance in Statement of Profit and Loss | 7,20,000 | 4,00,000 |

| Unpaid Dividend | 20,000 | – |

Additional Information:

(i) Proposed dividend on equity shares for the year 2019-20 and 2020-21 are ₹ 1,60,000 and ₹ 2,00,000 respectively.

(ii) An Interim Dividend of ₹ 40,000 on Equity Shares was paid.

Calculate Net Profit before Tax and Extraordinary Items.

SOLUTION:-

Q.7- Calculate Net Profit before Tax and Extraordinary Items of Premier Sales Ltd. from its Balance Sheet as at 31st March, 2021:

| Particulars | Note No. | 31st March, 2021 ( ₹ ) | 31st March, 2020 ( ₹ ) |

| I. EQUITY AND LIABILITIES | |||

| 1. Shareholders’ Funds | |||

| (a) Share Capital | 5,00,000 | 5,00,000 | |

| (b) Reserves and Surplus(Surplus, i.e., Balance in Statement of Profit and Loss) | 2,00,000 | 1,45,000 | |

| 2. Current Liabilities | |||

| (a) Trade Payables | 90,000 | 50,000 | |

| (b) Other Current Liabilities | 20,000 | 10,000 | |

| (c) Short-term Provisions | 1 | 50,000 | 30,000 |

| Total | 8,60,000 | 7,35,000 | |

| II. ASSETS | |||

| 1. Non-Current Assets | |||

| (a) Fixed Assets | 4,50,000 | 4,00,000 | |

| (b) Non-Current Investments | 50,000 | 1,50,000 | |

| 2. Current Assets | 2,60,000 | 1,85,000 | |

| Total | 8,60,000 | 7,35,00 |

Notes to Accounts

| Particulars | 31st March, 2021 ( ₹) | 31st March, 2020 ( ₹) |

| I. Short-term Provisions | ||

| Provision for Tax | 50,000 | 30,000 |

Additional Information:

(i) Proposed Dividend for the years ended 31st March, 2020 and 2021 are ₹ 50,000 and

₹ 75,000 respectively.

(ii) Interim Dividend paid during the year was ₹ 10,000.

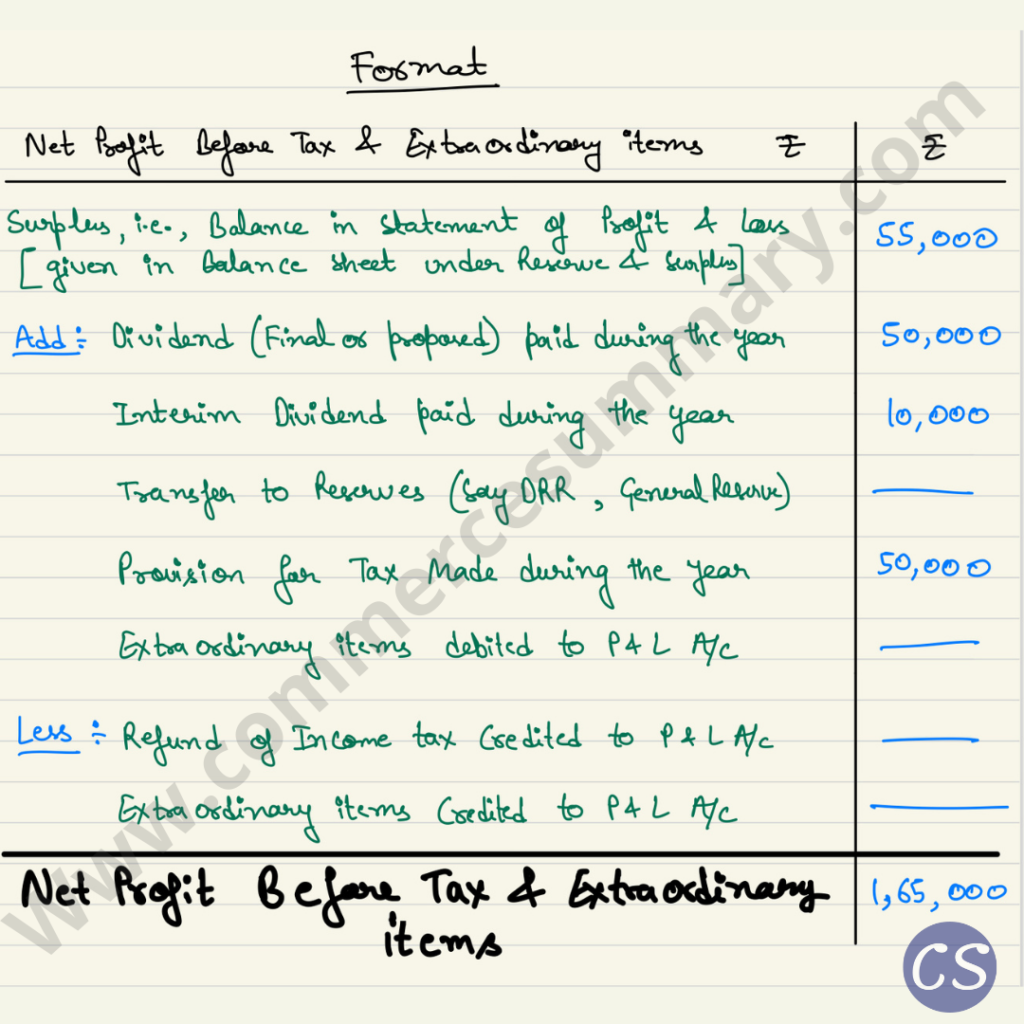

SOLUTION:-

Q.8- From the following information, calculate Net Profit before Tax and Extraordinary Items:

| Particular | ₹ |

| Surplus, i.e., Balance in Statement of Profit and Loss (Opening) | 1,00,000 |

| Surplus, i.e., Balance in Statement of Profit and Loss (Closing) | 3,36,000 |

| Dividend paid in the current year | 72,000 |

| Interim Dividend Paid during the year | 90,000 |

| Transfer to Reserve | 1,00,000 |

| Provision for Tax for the current year | 1,50,000 |

| Refund of Tax | 3,000 |

| Loss due to Earthquake | 2,00,000 |

| Insurance Proceeds from Earthquake disaster settlement | 1,00,000 |

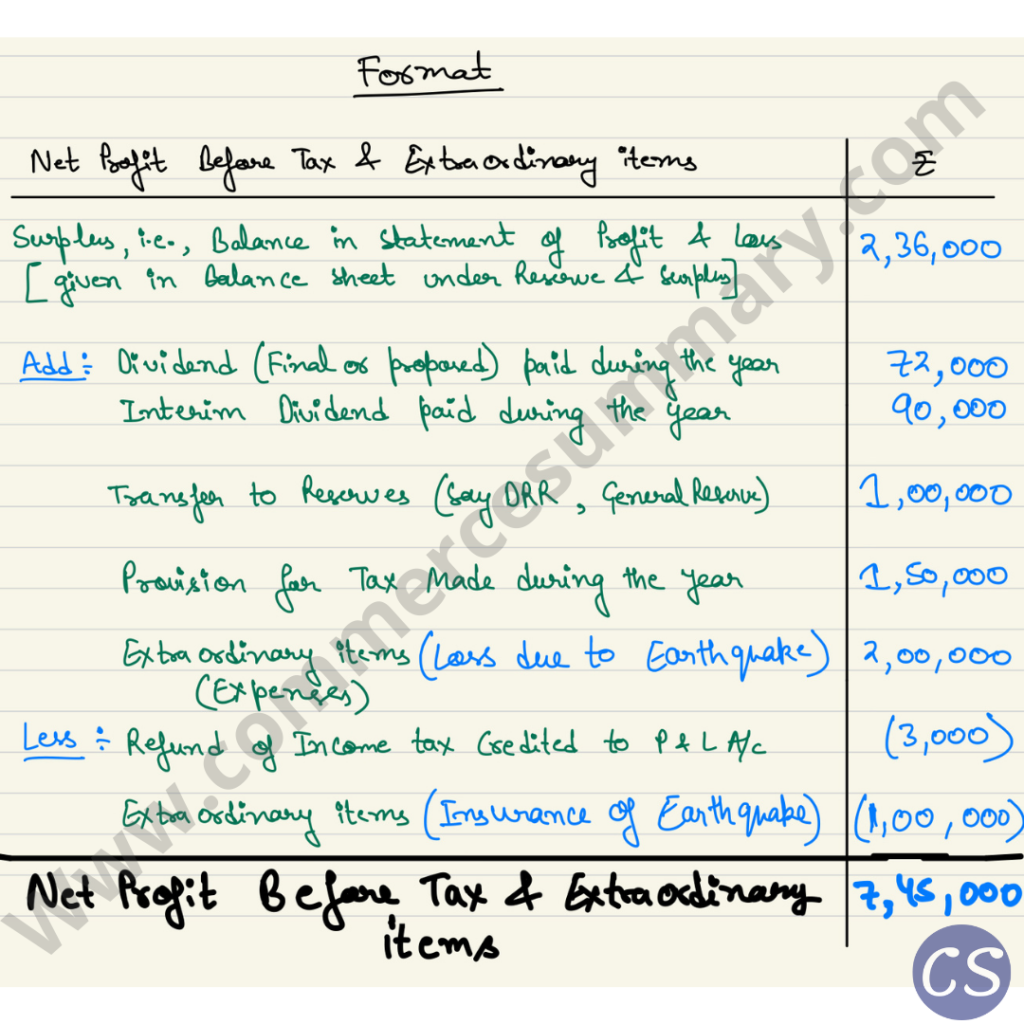

SOLUTION:-

Q.9- From the following information, calculate Net profit before tax and extraordinary item:

| ₹ | |

| Opening Surplus, i.e., Balance in Statement of Profit and Loss | (2,00,000) |

| Closing Surplus, i.e., Balance in Statement of Profit and Loss | 6,72,000 |

| Dividend paid in the current year (Last year’s proposed dividend) | 1,44,000 |

| Interim Dividend Paid during the year | 1,80,000 |

| Transfer to Reserve | 2,00,000 |

| Provision for Tax for the current year | 3,00,000 |

| Refund of Tax | 6,000 |

| Loss due to Earthquake | 4,00,000 |

| Insurance Proceeds from Earthquake disaster settlement | 2,00,000 |

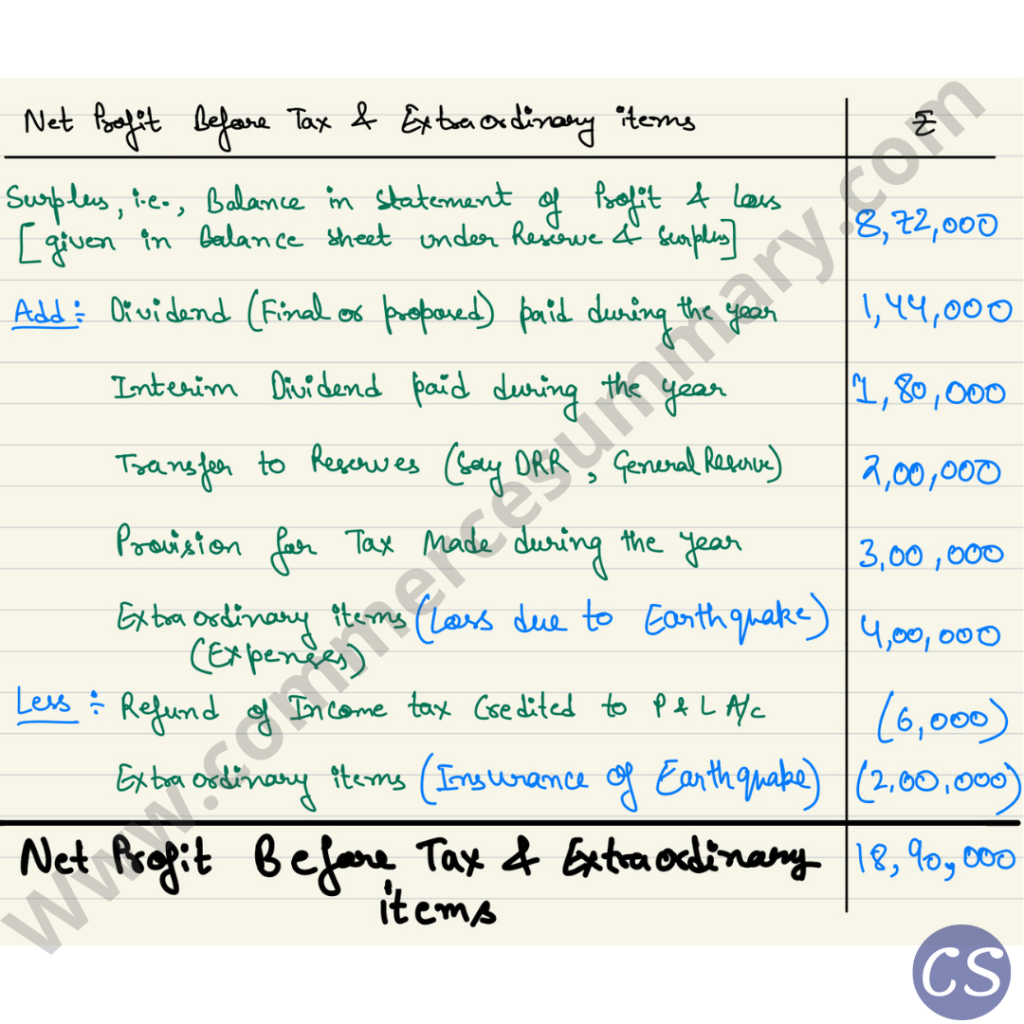

SOLUTION:-

Q.10- From the following information, calculate Operating Profit before Working Capital Changes:

| Items | ₹ |

| Net Profit before Tax and Extraordinary Items | 4,47,000 |

| Depreciation on Machinery | 84,000 |

| Interest on Borrowings | 16,800 |

| Goodwill Amortised | 18,600 |

| Loss on Sale of Furniture | 18,000 |

| Premium on Redemption of Preference Shares | 6,000 |

| Gain (Profit) on Sale of Investments | 12,000 |

| Interest and Dividend Received on Investments | 27,600 |

SOLUTION:-

Note- Assuming Premium on Redemption of Preference Shares has been paid out of the Securities Premium Reserve Balance.

Cash Flow Statement

for the year ended March 31, ….

| Particulars | Inner column Amount ( ₹) | Amount ( ₹) | |

| A | Cash Flow from Operating Activities | ||

| Net Profit Before Taxation and Extraordinary Items | 4,47,000 | ||

| Items to be Added: | |||

| Depreciation on Machinery | 84,000 | ||

| Loss on Sale of Furniture | 18,000 | ||

| Interest on Borrowings | 16,800 | ||

| Goodwill Amortized | 18,600 | ||

| 1,37,400 | |||

| Items to be Deducted: | |||

| Profit on Sale of Investment | (12,000) | ||

| Interest and Dividend Received on Investment | (27,600) | (39,600) | |

| Operating Profit before Working Capital Adjustments | 5,44,800 |